Renters Insurance in and around Covington

Welcome, home & apartment renters of Covington!

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

There are plenty of choices for renters insurance in Covington. Sorting through savings options and coverage options to pick the right one can be overwhelming. But if you want budget-friendly renters insurance, choose State Farm for covering all of your belongings and personal items. Your friends and neighbors enjoy remarkable value and no-nonsense service by working with State Farm Agent John Garrett. That’s because John Garrett can walk you through the whole insurance process, step by step, to help ensure you have coverage for everything you own inside your rental, including linens, sound equipment, electronics, appliances, and more! Renters coverage like this is what sets State Farm apart from the rest. Agent John Garrett can be there to help whenever the unexpected happens, to get you back in your routine. State Farm provides you with insurance protection and is here to help!

Welcome, home & apartment renters of Covington!

Renters insurance can help protect your belongings

Why Renters In Covington Choose State Farm

Renters insurance may seem like last on your list of priorities, and you're wondering if you really need it. But imagine what it would cost to replace all the personal property in your rented home. State Farm's Renters insurance can help when abrupt water damage from a ruptured pipe damage your stuff.

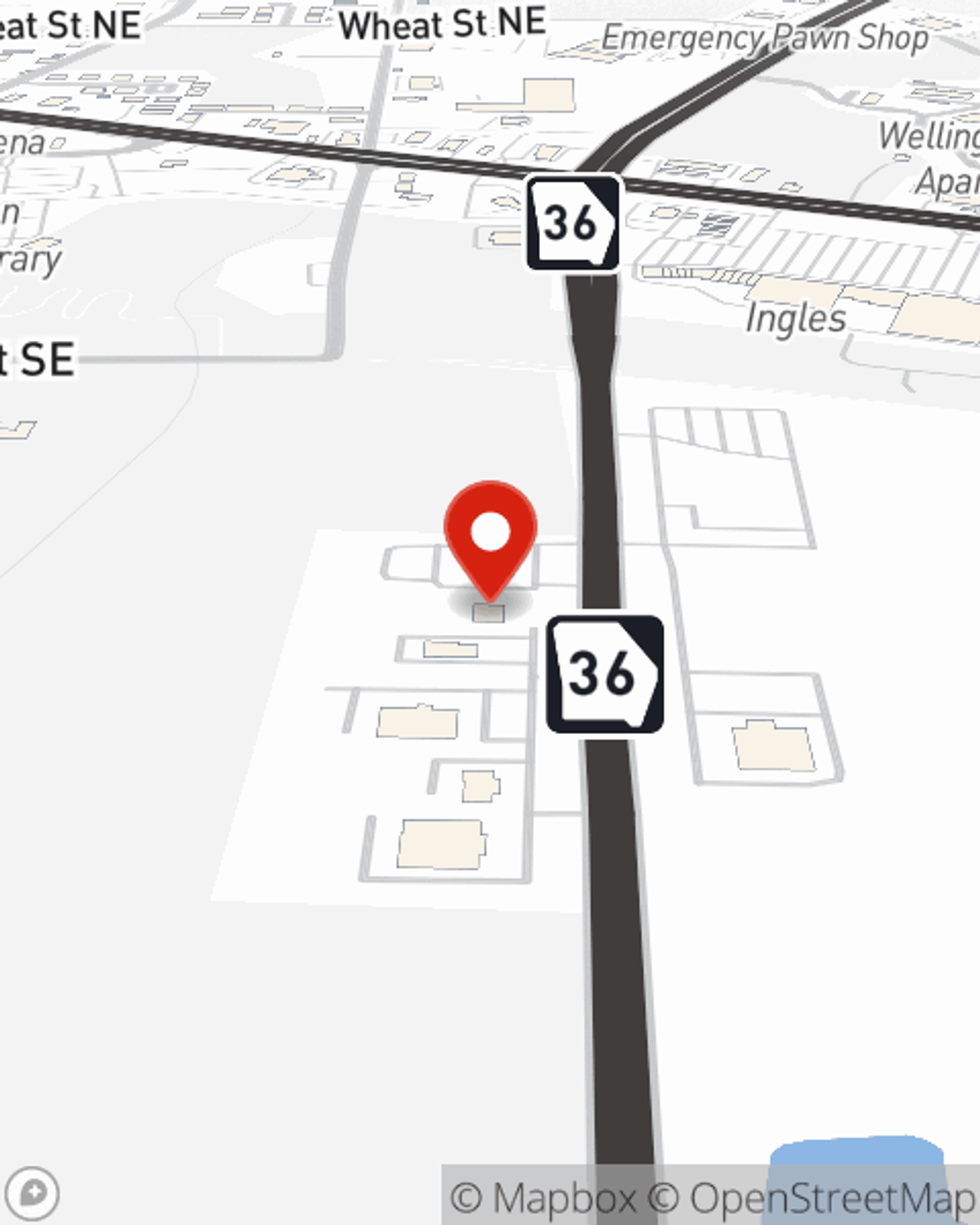

As a commited provider of renters insurance in Covington, GA, State Farm helps you keep your belongings protected. Call State Farm agent John Garrett today for a free quote on a renters policy.

Have More Questions About Renters Insurance?

Call John at (770) 787-1111 or visit our FAQ page.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

John Garrett

State Farm® Insurance AgentSimple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.