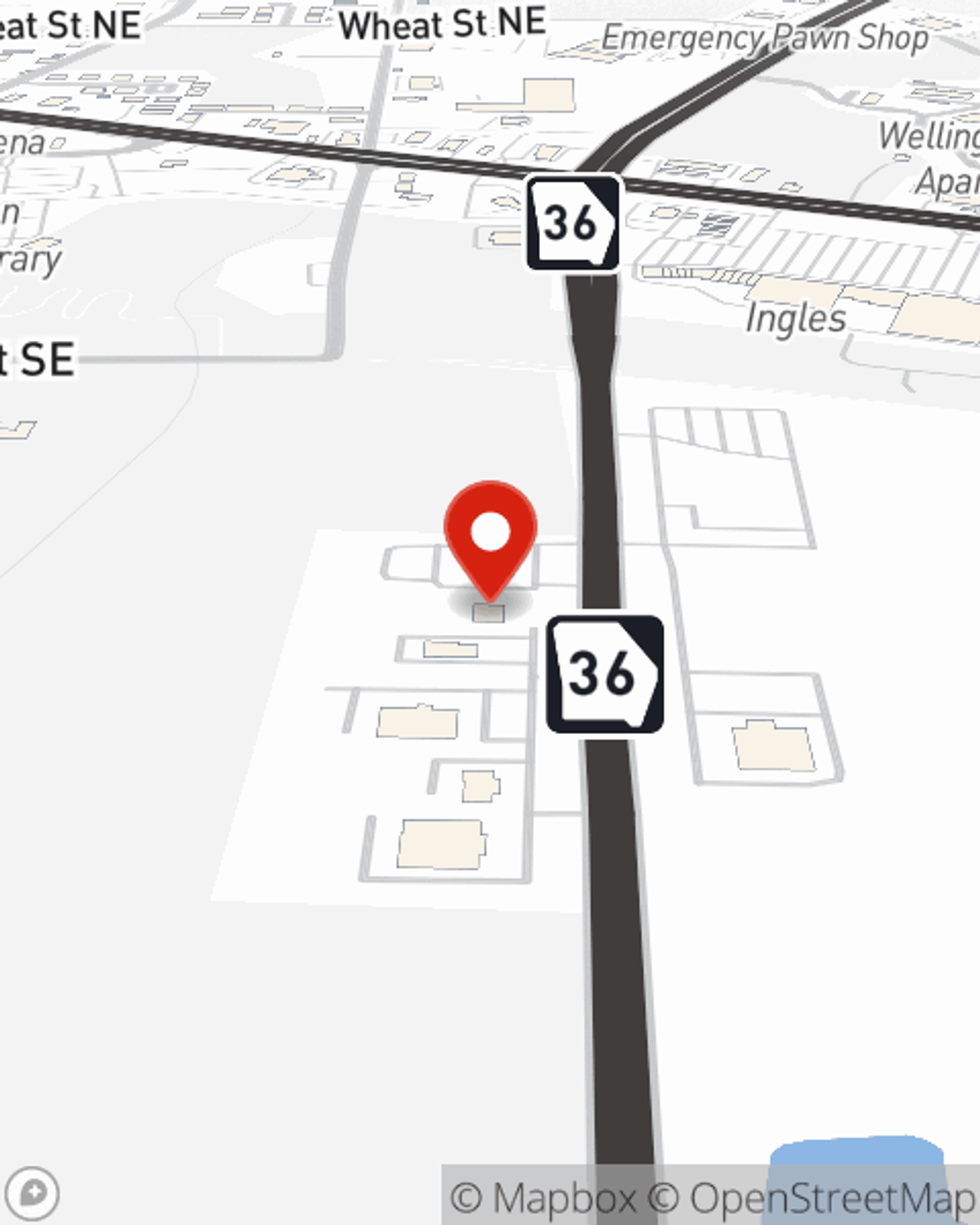

Business Insurance in and around Covington

Covington! Look no further for small business insurance.

Insure your business, intentionally

Insure The Business You've Built.

When experiencing the challenges of small business ownership, let State Farm be there for you and help provide outstanding insurance for your business. Your policy can include options such as worker's compensation for your employees, errors and omissions liability, and business continuity plans.

Covington! Look no further for small business insurance.

Insure your business, intentionally

Protect Your Business With State Farm

At State Farm, apply for the great coverage you may need for your business, whether it's a camping store, a barber shop or an ice cream store. Agent John Garrett is also a business owner and understands what you need. Not only that, but customizable insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage comes out on top.

Agent John Garrett is here to talk through your business insurance options with you. Reach out John Garrett today!

Simple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

John Garrett

State Farm® Insurance AgentSimple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.